Portrait of pretty blonde model sitting on table.

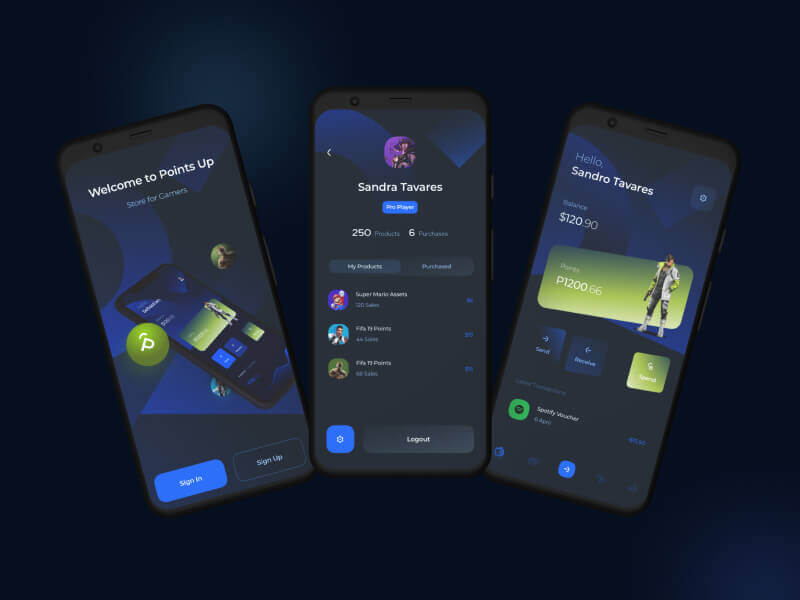

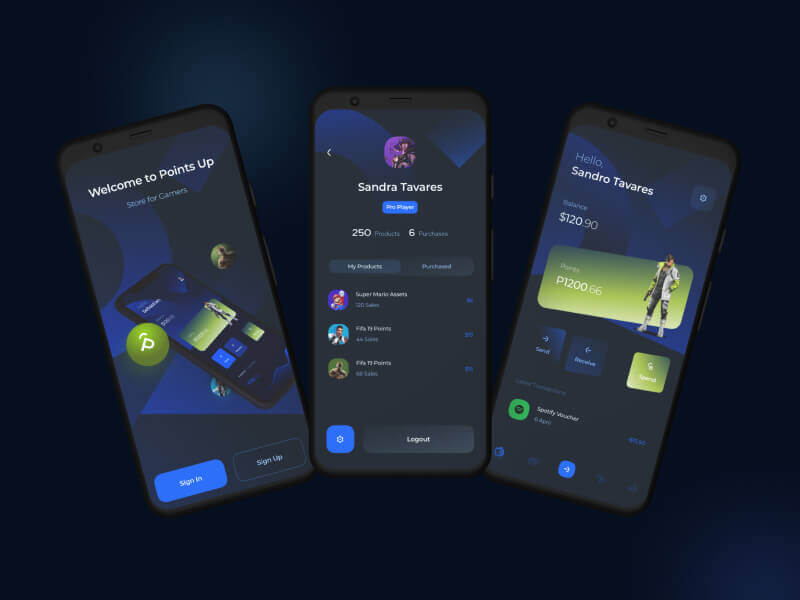

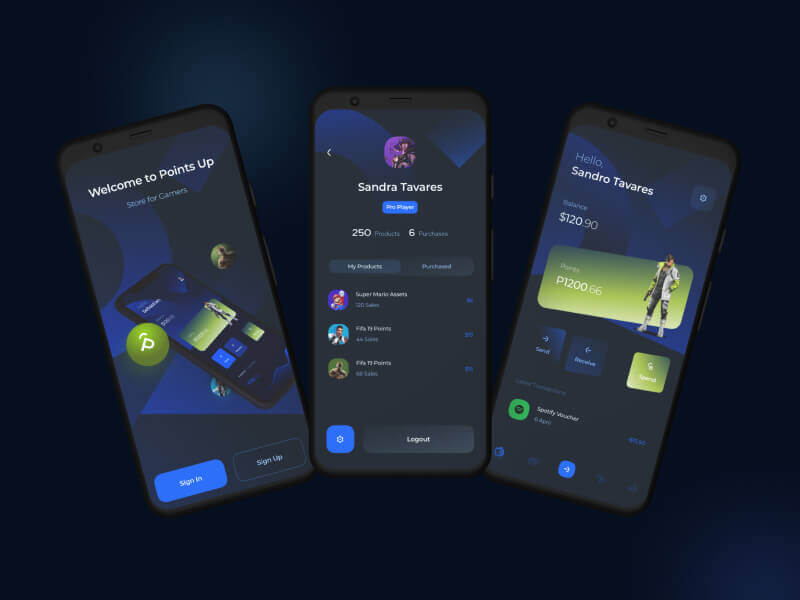

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Lorem ipsum, dolor sit amet consectetur

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Eum in eos saepe ipsa cupiditate accusantium voluptatibus quidem nam, reprehenderit, et necessitatibus adipisci labore sit veritatis vero tempore sequi at sed facere dolore. Quae obcaecati eius quasi doloribus illum minus fugit.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Eum in eos saepe ipsa cupiditate accusantium voluptatibus quidem nam, reprehenderit,

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them.

Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

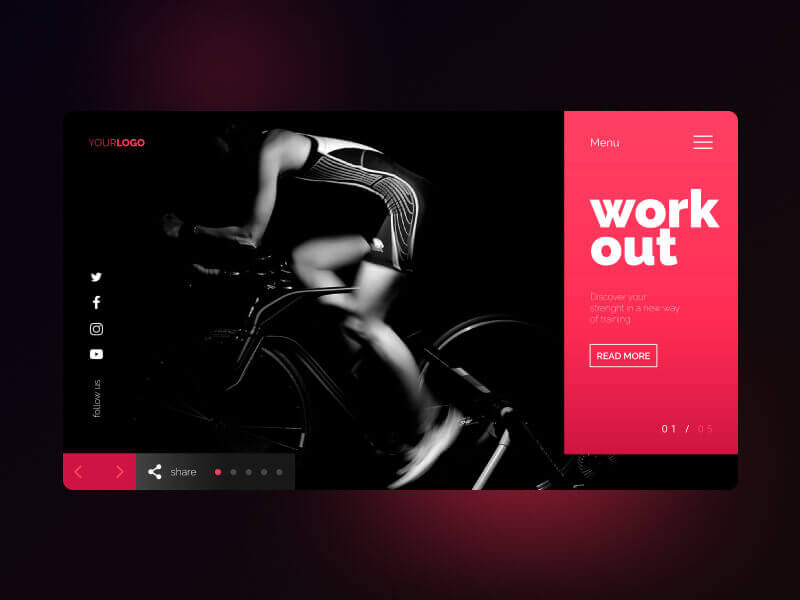

A strategy is a general plan to achieve one or more long-term.

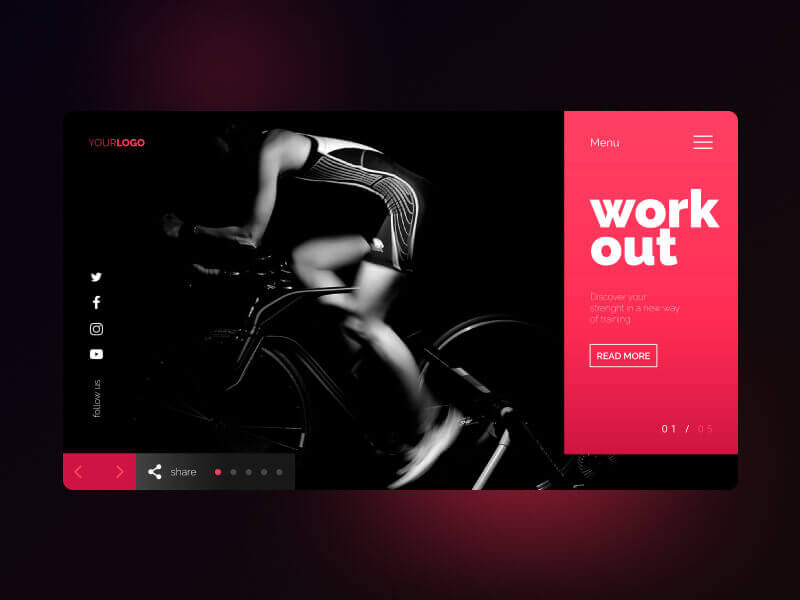

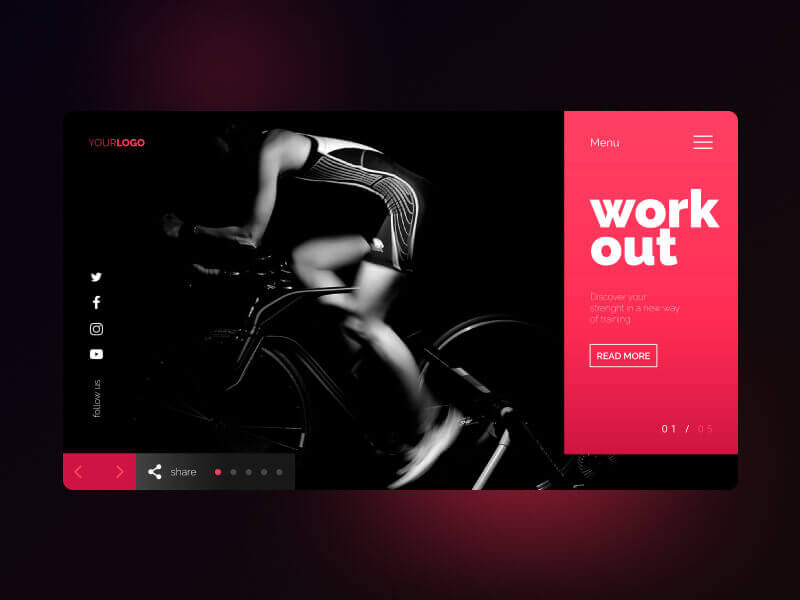

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris test

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris

Understanding tax planning is essential for entrepreneurs aiming to boost business growth and sustain financial well-being. Effective strategies—leveraging tax deferrals, optimizing deductions, and supporting policy reforms—play a vital role in enhancing cash flow, maximizing returns, and encouraging investment in new ventures.

Entrepreneurs often split their income into capital and labor income. This division impacts tax planning. Capital income includes investment returns, while labor income encompasses earnings from efforts. Effective tax rates can affect a company’s investment returns. Higher rates may necessitate higher returns, potentially discouraging new ventures.

Leveraging tax deferral strategies offers significant advantages. Entrepreneurs can potentially defer capital gains taxes until they realize profits. This can reduce the immediate tax burden and enhance after-tax returns.

Careful planning around these strategies helps optimize finances and stimulate business growth.

Effective tax management is crucial for entrepreneurs aiming to grow their business. Understanding deductible expenses can significantly reduce your tax burden. Small businesses can take advantage of deductions such as:

These deductions align with IRS guidelines, ensuring compliance while optimizing your potential savings.

Claiming these deductions requires accurate record-keeping. Ensure that you maintain detailed records, including receipts and invoices, to substantiate your claims. Expenses like business meals should be documented with dates, attendees, and the business purpose of the meal. For travel expenses, provide travel itineraries, tickets, and hotel receipts. Keep a comprehensive list of office equipment purchases with associated invoices.

Regarding start-up and organizational costs, the IRS allows you to deduct up to $5,000 each for these expenses, provided the total costs do not exceed $50,000 in each category. If your start-up or organizational costs are above $50,000, the deduction decreases dollar-for-dollar. Any excess over $5,000 must be amortized over 15 years.

Understanding the limits and regulations of these deductions ensures you don’t overlook potential savings. Taking full advantage of available deductions can free up resources for reinvestment in your business, facilitating further growth. Regularly consulting with a tax professional can offer insights into complex tax situations, enhancing your financial strategies.

Implementing a 20% flat tax rate can significantly increase entrepreneurial activities, potentially tripling them. When profits and losses are taxed differently, it impacts risk-taking behavior. Entrepreneurs might shy away from investment opportunities under progressive tax schedules that penalize higher earnings.

To combat this, offering tax rebates to non-corporate firms for losses beyond taxable income could stimulate growth, possibly increasing entrepreneurial activity by 50%. Such strategies alleviate financial burdens during challenging times, incentivizing further investment and innovation.

Analyzing these tax reforms reveals their profound influence on entrepreneurship. By aligning tax structures to support risk-taking and innovation, governments can nurture a thriving business landscape. Entrepreneurs, in turn, gain confidence to pursue ventures that drive economic growth.

The fixed costs associated with tax compliance can often stymie entrepreneurial ventures, both new and established. These expenses, which do not fluctuate with sales volume, can strain resources and impede business decisions. High compliance costs can therefore lead to losses, making the journey less appealing for budding entrepreneurs or causing premature business closure for existing ones.

Consider the example of a small retail start-up. This business might face a significant financial outlay just to ensure adherence to tax regulations, which adds financial pressure before any sales are made. Similarly, a local cafe might decide against hiring more staff due to the financial burden from fixed compliance costs.

Understanding these complexities, entrepreneurs should consider consulting with tax professionals who can provide guidance and navigate these challenges efficiently, potentially transforming a daunting process into a more manageable task.

Sources:

Tax Policy and Entrepreneurship: A Framework for Analysis

25 Small Business Tax Deductions (Write Offs) in 2025

Publication 583 (12/2024), Starting a Business and Keeping Records

Taxes and Entrepreneurial Activity

34 Big Tax Deductions (Write-Offs) for Businesses in 2025

Successfully handling tax obligations is crucial for startups and small businesses wanting to remain compliant and financially healthy, especially during times of growth and expanding teams. By taking advantage of deductions and credits, and keeping accurate financial records, companies can strategically navigate tax planning, optimizing savings and encouraging long-term prosperity.

Startups and small businesses juggle several tax obligations. Income tax focuses on net profits, which reflects the true earnings after deductible expenses. Payroll taxes, an inescapable part, include contributions to Social Security and Medicare. Partners in pass-through entities have to account for self-employment taxes on their income share, impacting personal returns.

Expanding into multiple states or utilizing remote workforces adds layers to tax responsibilities. Every state may have unique tax rules, requiring careful attention to ensure compliance. It’s crucial for any startup to fully grasp these obligations not just to avoid penalties, but also to preserve financial health.

Understanding and utilizing tax deductions and credits can play a crucial role in reducing the taxable income of startups and small businesses. These tools not only help in managing taxes but also in reinvesting savings back into the business.

These key deductions might be considered:

Retirement contributions also afford opportunities for tax savings. Options like the SEP IRA and SIMPLE IRA enable income reduction through tax-deferred contributions, while securing a financial future.

Tax credits provide direct reductions to your tax bill. The Work Opportunity Tax Credit incentivizes hiring from certain employee groups, enhancing workforce diversity and skillsets. Meanwhile, the Disabled Access Credit supports small businesses in improving accessibility, reflecting a commitment to inclusivity.

Strategically combining these deductions and credits helps lower tax obligations, allowing startups and small businesses to maximize financial growth and stability.

Accurate management of estimated tax payments keeps your business penalty-free. If you owe more than $1,000 in annual taxes, the IRS wants quarterly payments. Be sure to rely on precise calculations by considering all projected income, deductions, and credits.

Here’s why you should make timely payments:

Plan these calculations carefully and stay ahead of deadlines. It all contributes to smoother tax compliance and financial peace of mind.

Keeping thorough financial records is crucial for precise tax filings. Without detailed documentation, startups and small businesses risk inaccuracies that could lead to penalties. Essential records to maintain include income and expense reports, relevant receipts, payroll data, and depreciation schedules. Each type plays a specific role in the overall picture of financial health. Income reports provide insights into revenue streams, while expense reports help in tracking outgoing funds. Relevant receipts serve as evidence for tax-deductible expenses. Payroll data ensures compliance with employment tax regulations. Finally, depreciation schedules account for the gradual loss in value of business assets over time.

Advancements in accounting software have made organization more intuitive and efficient. QuickBooks, Xero, and Wave offer tools that simplify recordkeeping with features such as automated data entry, real-time tracking, and financial reporting. These programs not only reduce manual errors but also enhance the speed and accuracy of tax preparation.

Utilizing such digital tools offers other benefits too. They proactively sync bank transactions and categorize expenses, making it easier to review financial status. Cloud-based features ensure data is securely backed up and accessible from anywhere, providing flexibility for business owners on the go. Embracing technology for financial management helps maintain organized records, ultimately supporting effective tax planning and assessment.

Strategic tax planning isn’t just about cutting liabilities. It’s a critical approach for sustained business success. Understanding tax regulations can lead to growth and compliance. Implement these strategies to help maximize deductions and stabilize your financial standings:

Proactive planning is vital for financial stability and fostering business growth. Aligning tax strategies with business objectives ensures potential pitfalls are avoided. Effective tax planning, therefore, plays a crucial role in securing robust financial health and paves the way for sustainable growth.

Sources:

Bette Hochberger, CPA, CGMA: “Tax Planning for Startups”

LendingTree: “5 Tax Planning Strategies for Small Businesses”

Founders Network: “Startup Financials 101: Everything You Need To Know”

Preferred CFO: “Tax Planning Strategy For Small Businesses”

Escalon: “Tax Planning for Startups: Preparing for Your First Tax Filing”

In today’s dynamic business environment, effective tax planning is not just a necessity—it’s a competitive advantage. Strategic tax measures can significantly enhance a company’s financial health, creating opportunities for reinvestment and long-term growth.

Understanding Tax Planning

Tax planning involves structuring a company’s financial activities to minimize tax liabilities while remaining compliant with the law. Key strategies include income deferral, maximizing deductions, leveraging tax-advantaged accounts, and taking full advantage of sector-specific tax breaks. For instance, the UK’s Super Deduction allows businesses to claim 130% of qualifying capital expenditures, offering significant savings for reinvestment.

Key Tax Strategies for Businesses

Long-Term Tax Planning

Strategic tax planning isn’t just about saving money now—it’s about aligning tax strategies with business growth goals. Proactive planning ensures compliance and readiness for opportunities like mergers, acquisitions, or Nasdaq listings.

Ready to elevate your tax strategy? Contact Issac Qureshi today for personalized, effective solutions that minimize tax liabilities and fuel business growth.

I am available for freelance work. Connect with me via and call in to my account.

Phone: +01234567890 Email: admin@example.com